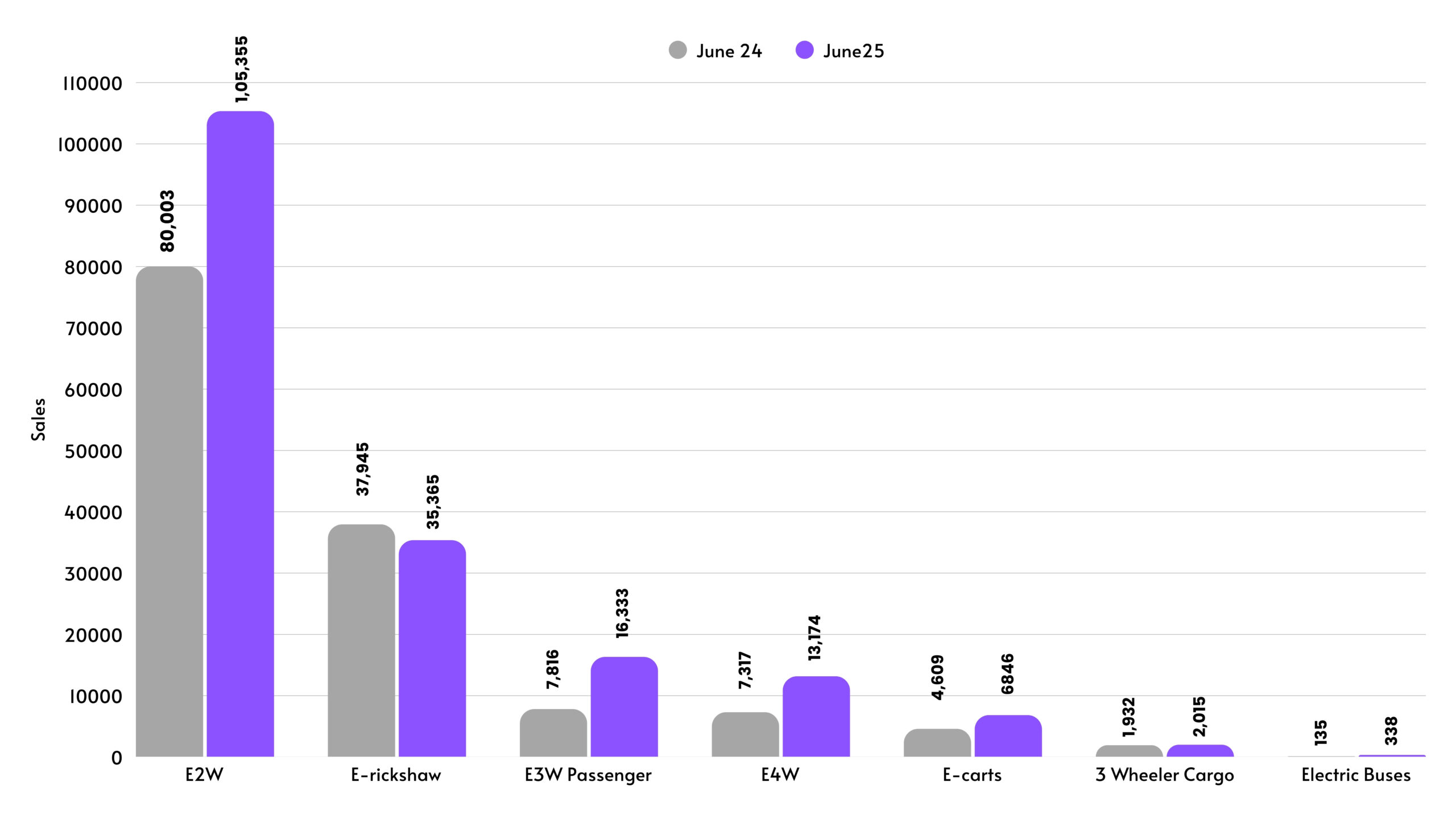

India’s electric vehicle (EV) market continued its electrifying ascent in June 2025, registering a robust 179,617 units sold, according to data from the Vahan Dashboard via EVreporter. With a 28.2% year-on-year (YoY) surge from June 2024’s 139,242 units, the EV sector is gaining momentum, driven by government incentives like the PM E-DRIVE scheme and growing consumer appetite for sustainable mobility.

Electric two-wheelers dominated, while electric buses posted a staggering 291.85% YoY growth, signaling a shift in public transport. Below, we break down the category-wise sales trends, spotlight the top five OEMs in two-wheeler and four-wheeler segments, and highlight key market dynamics for June 2025.

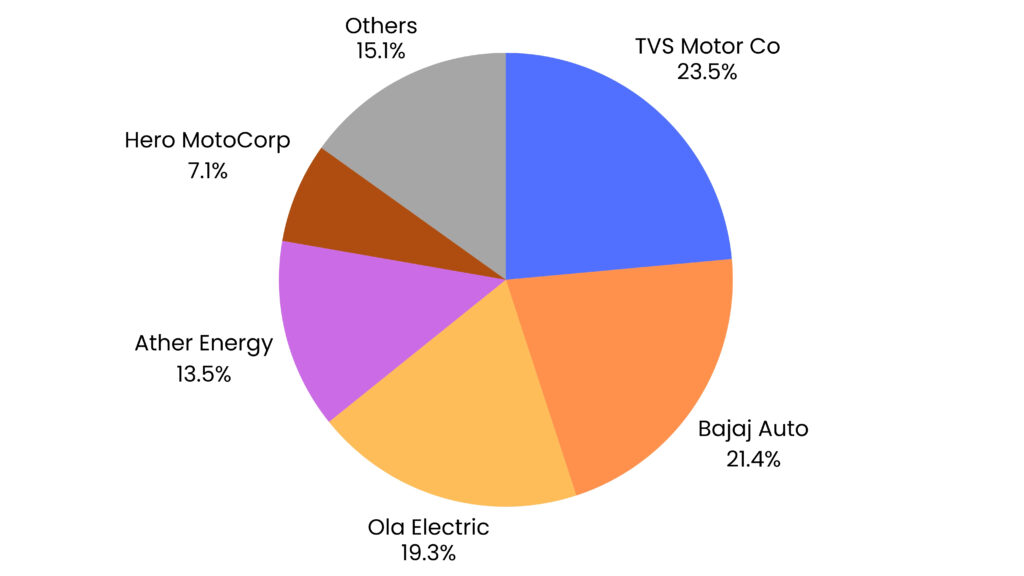

Top 5 EV Two-Wheeler OEMs

The electric two-wheeler market in June 2025 was dominated by TVS Motor Co., which sold 25,274 units, capturing a 23.98% market share, primarily through its iQube model. Bajaj Auto followed closely with 23,004 units (21.83% share), driven by the Chetak, marking a 154% YoY sales increase. Ola Electric, despite a 45% YoY decline, sold 20,189 units, holding a 19.16% share. Ather Energy secured the fourth spot with 14,512 units (13.77% share), reflecting steady growth. Hero MotoCorp rounded out the top five with 7,664 units, commanding a 7.27% share, as the market saw increased competition and diversification among OEMs.

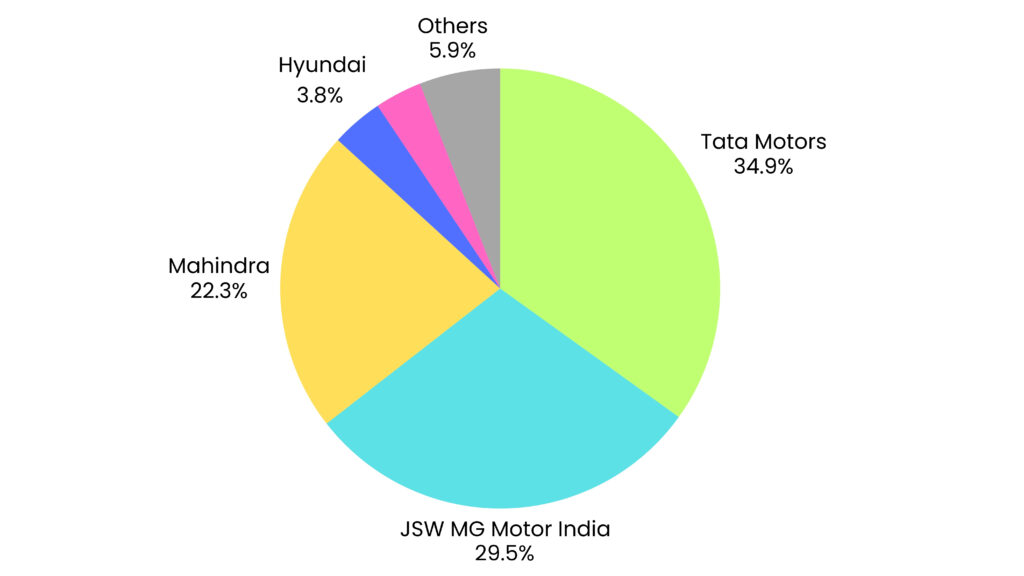

Top 5 Electric Four-Wheeler OEMs