The Indian electric vehicle (EV) market experienced a general slowdown in sales in April 2025 compared to the preceding month of March. Overall registered EV sales decreased from 2,04,798 units in March to 1,67,520 in April. A significant drop in the electric two-wheeler segment primarily drove this decline. Despite this month-on-month decrease, certain categories, such as e-rickshaws and e-carts, demonstrated positive growth. Among manufacturers, TVS emerged as the top seller in the electric two-wheeler category for the first time, while Tata Motors continued to lead the electric four-wheeler market, albeit with a reduced market share. These trends indicate a dynamic and evolving landscape within the Indian electric mobility sector.

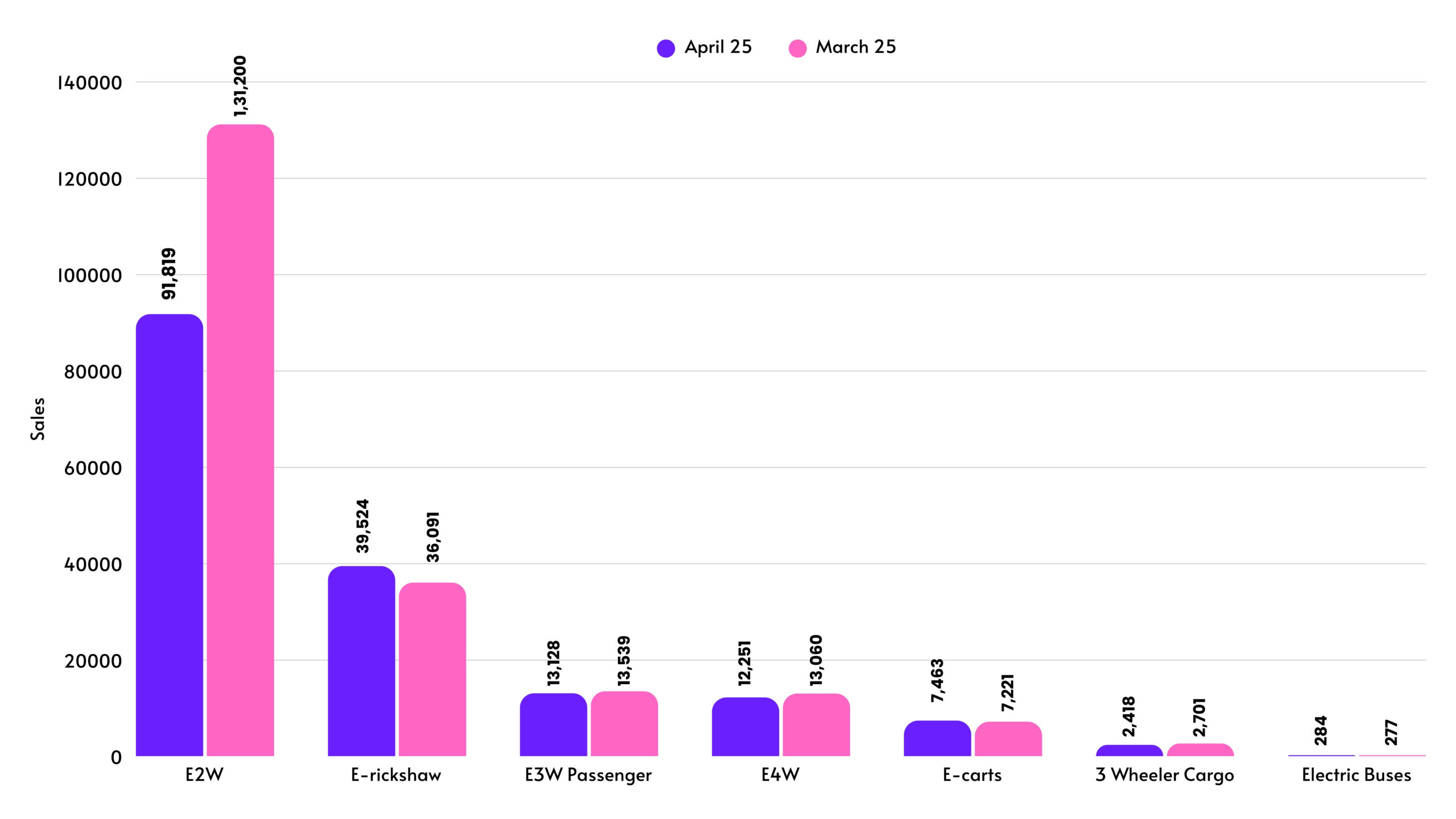

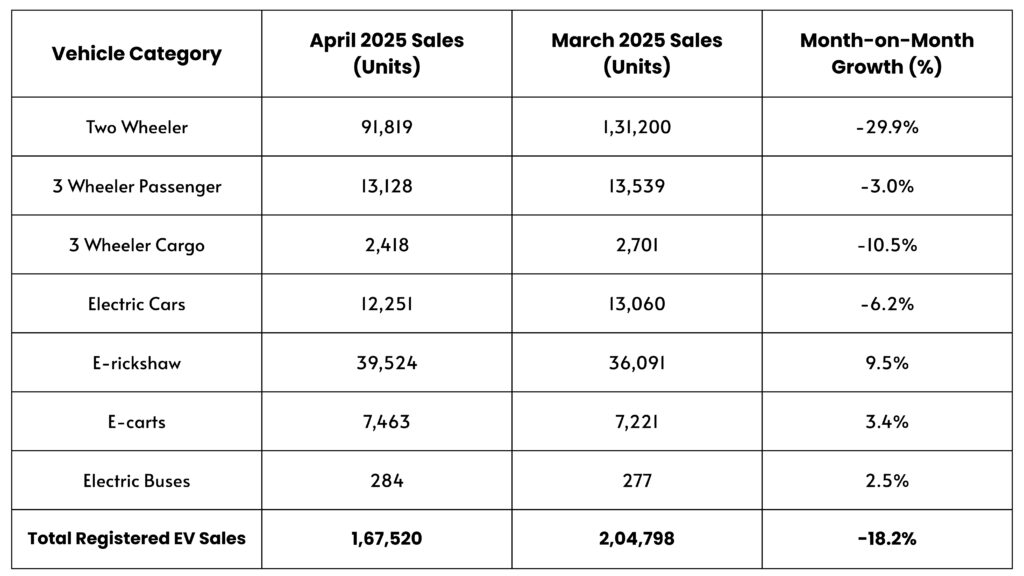

Category-wise Electric Vehicle Sales Comparison:

The following table provides a detailed comparison of electric vehicle sales across various categories in India for April and March 2025. It includes the absolute sales figures for each month and the month-on-month growth percentage.

Source: Vahan Dashboard as of May 2, 2025, and April 2, 2025. Telangana data not included.

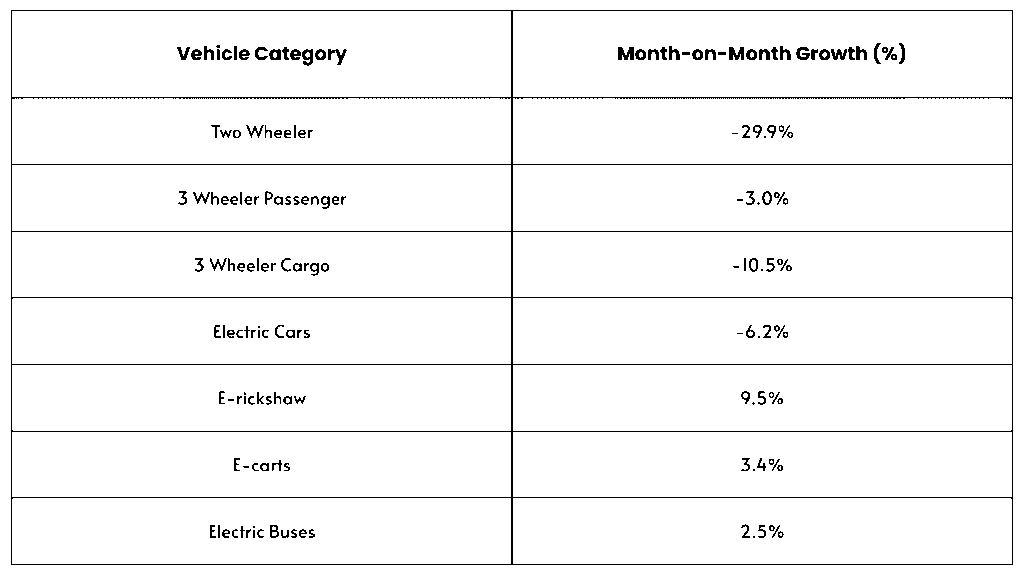

The data reveals a significant overall decrease in EV sales in April 2025 compared to March 2025. The most substantial decline was observed in the electric two-wheeler category, which saw a drop of approximately 29.9%. Electric car sales also experienced a notable decrease of 6.2%. In contrast, e-rickshaw sales increased by 9.5%, and e-cart sales rose by 3.4%. The sales of electric buses remained relatively stable, showing a slight increase of 2.5%. The decrease in total sales suggests a potential market adjustment or seasonal variation following a strong performance in March. The growth in the e-rickshaw and e-cart segments indicates continued demand for these vehicles in the last-mile mobility sector.

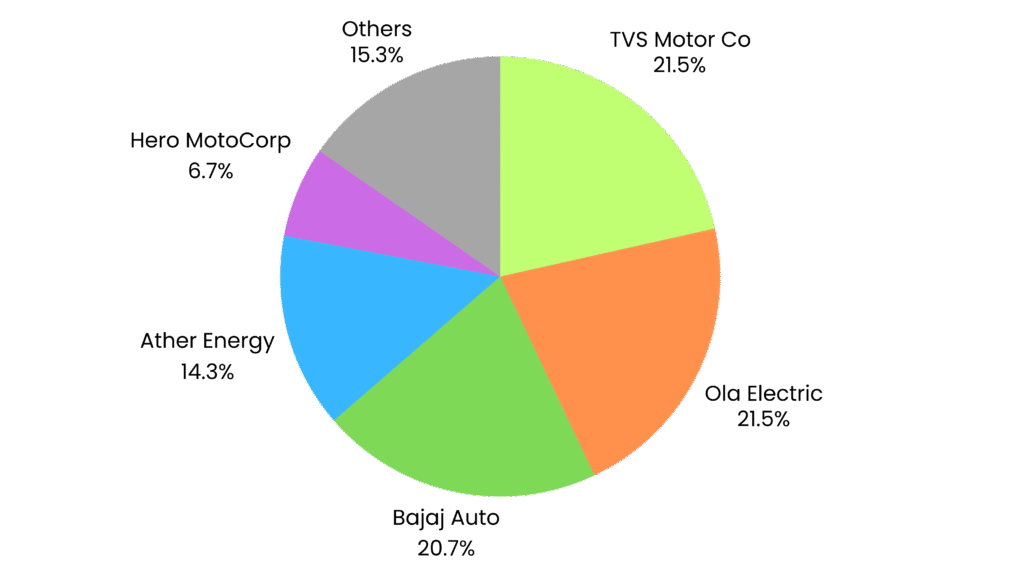

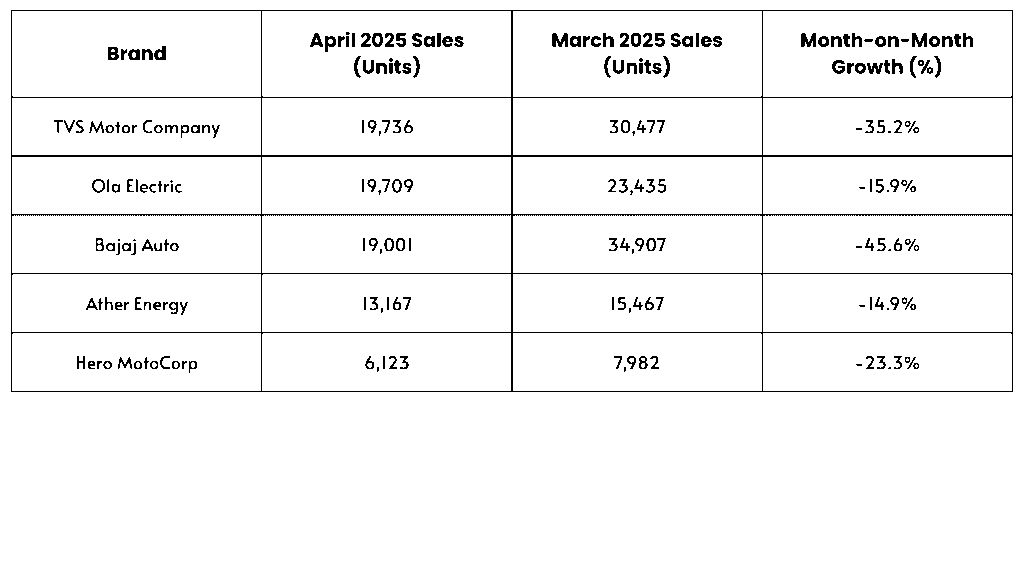

Top 5 Electric Two-Wheelers Manufacturer Sales Comparison

The top 5 electric two-wheeler brands in India for April 2025 were TVS Motor Company, Ola Electric, Bajaj Auto, Ather Energy, and Hero MotoCorp. For March 2025, the top brands were Bajaj Auto, TVS Motor Company, Ola Electric, Ather Energy, and Hero MotoCorp. It is important to note that there might be minor variations in the exact sales figures reported by different sources due to differing data collection timelines.

A significant development in April 2025 was TVS Motor Company surpassing Ola Electric and Bajaj Auto to become the top-selling electric two-wheeler brand for the first time. This indicates a potential shift in market preference or the effectiveness of TVS’s product strategy. While Ola Electric maintained a strong second position, its sales witnessed a decline compared to March. Bajaj Auto, which led the sales in March, experienced the most significant drop in sales among the top 5 brands in April. Ather Energy and Hero MotoCorp also recorded lower sales in April compared to March. The overall decrease in sales for the top 5 brands aligns with the general downturn observed in the electric two-wheeler segment.

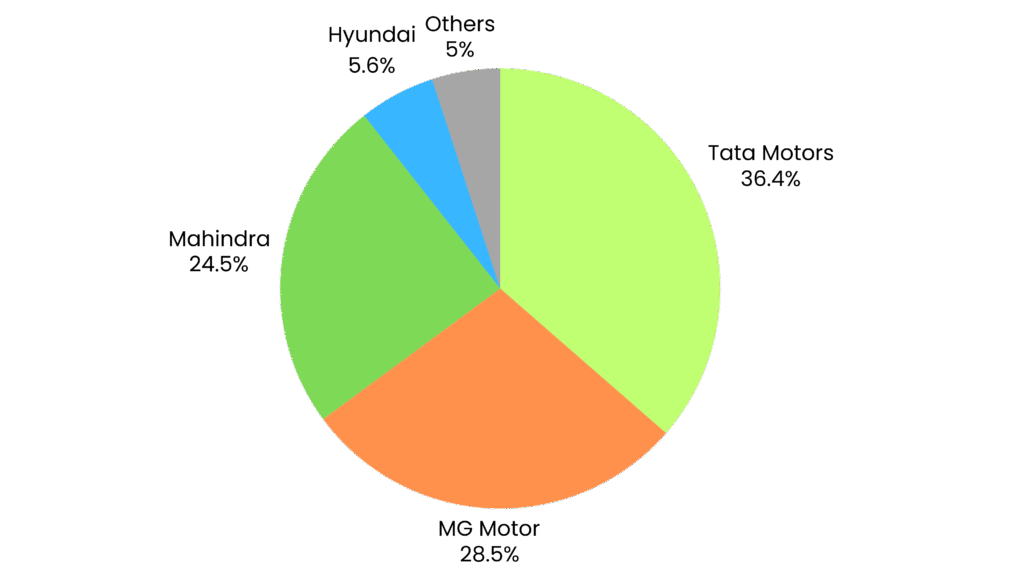

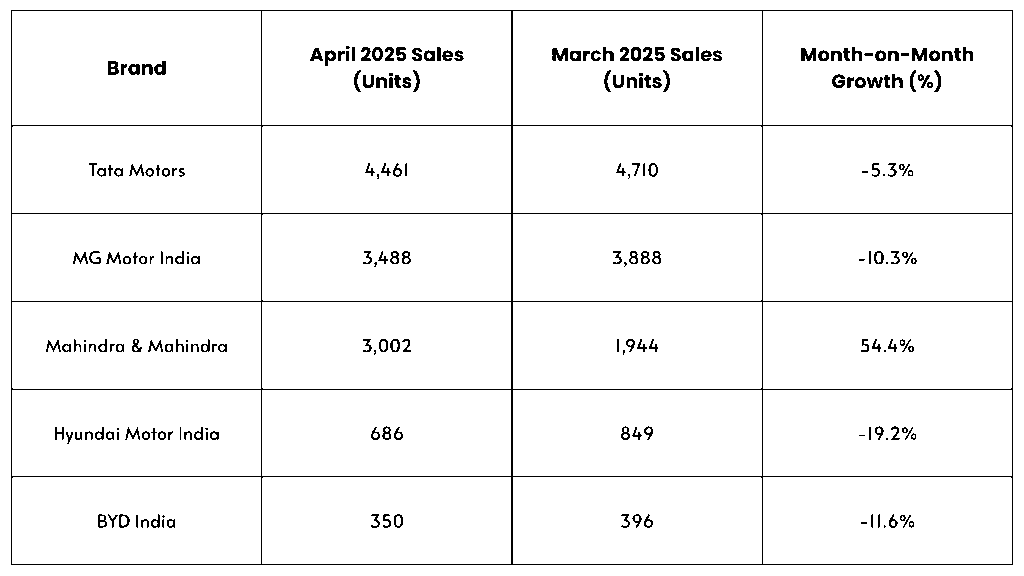

Top 5 Electric Four-Wheelers Manufacturer Sales Comparison

The top 5 electric four-wheeler brands in India for both April and March 2025 were Tata Motors, MG Motor India, Mahindra & Mahindra, Hyundai Motor India, and BYD India.

Tata Motors continued its dominance in the electric four-wheeler market in April 2025, although its sales saw a slight decrease compared to March. MG Motor India also experienced a decline in sales between the two months. A notable trend was the significant increase in sales for Mahindra & Mahindra in April, driven by the deliveries of their new electric SUVs, the BE 6 and XEV 9e. Hyundai Motor India and BYD India both recorded lower sales in April compared to March. The data suggests a shifting competitive landscape within the electric four-wheeler segment, with Mahindra gaining momentum.

Three-Wheeler and Other Segments

The electric three-wheeler passenger vehicle segment saw a marginal decrease in sales from 13,539 units in March to 13,128 units in April. The electric three-wheeler cargo vehicle segment experienced a more significant decline, with sales falling from 2,701 units in March to 2,418 units in April. This could be due to various factors affecting the demand for goods transportation. In contrast, the e-rickshaw segment witnessed a notable increase in sales, rising from 36,091 units in March to 39,524 units in April. Similarly, e-cart sales increased from 7,221 units in March to 7,463 units in April. This growth in the lower-speed, last-mile mobility segments suggests continued demand for these types of vehicles, likely driven by their affordability and suitability for urban environments. Electric bus sales remained relatively stable, with 284 units sold in April compared to 277 units in March. Data for electric truck sales was not explicitly available in the provided snippets for a month-on-month comparison. The contrasting trends within the three-wheeler market highlight the diverse factors influencing adoption across different sub-segments.

Month-on-Month Percentage Growth by Category